Hamilton’s Vision of a Nation that Works for Everyone

How does a bastard, orphan, son of a whore

And a Scotsman, dropped in the middle of a forgotten

Spot in the Caribbean by providence, impoverished, in squalor

Grow up to be a hero and a scholar?

Those are the opening lines of the song “Alexander Hamilton” that kicks off the play that bears his name.

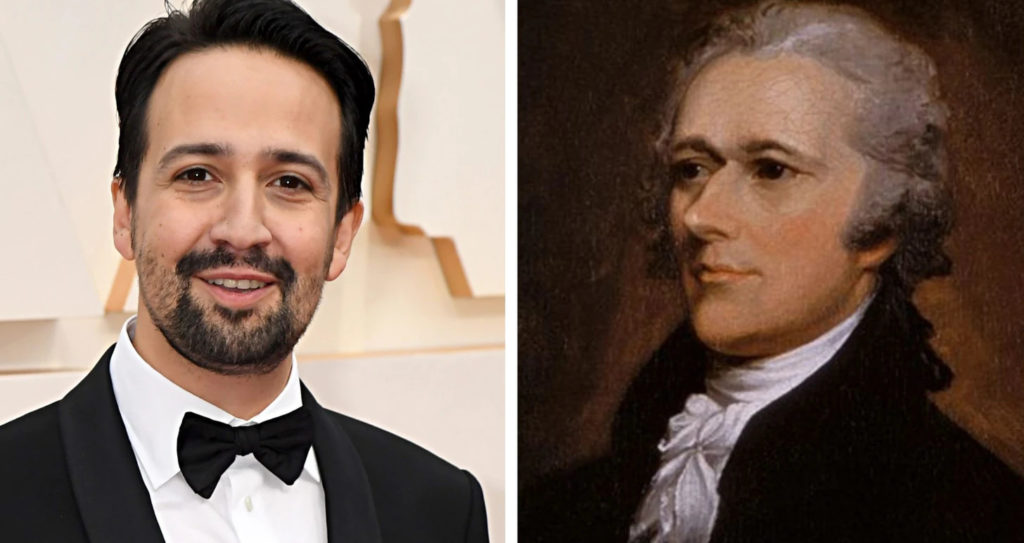

Now, you may know Alexander Hamilton as the star of that smash Broadway play, but before he was hobnobbing with famous celebrities, he was the first Treasury Secretary of the United States. His grasp of economics, banking and public finance was so keen that it is thanks to him that the U.S. became a prosperous nation and an industrial powerhouse.

Hamilton’s vision of what it would take for the budding nation to thrive was so clear that he was able to easily convince Congress and President George Washington to abide by it and set up the Bank of the United States. This was essentially a central bank, one that issued Treasury Notes and a currency of its own, all to finance, through the vehicle of public debt, the growth of the nation. The money raised was spent primarily on public infrastructure, along with public research and development in order to create new products and manufacturing techniques.

Alexander Hamilton recognized the power of public debt. He called it “a national blessing,” and understood that debt was the engine that allowed a country to grow; ultimately, public debt is what enabled the U.S. to become the richest nation in the history of the planet. Hamilton’s Bank of the United States took on debt through its issuance of Treasury notes and currency; by expanding the money supply and taking on public debt through these mechanisms, the U.S. was able to finance its expansion as it established infrastructure and developed and innovated new manufacturing techniques and inventions.

Through Hamilton’s foresight, America began its progression into the rich and prosperous nation it is today. But the progression wasn’t a linear trajectory straight up, as all along the way there were many bumps in the road.

The first of the impediments was something that has occurred time and again throughout history—wealthy elite feeling their assets threatened and flexing their muscle to halt the encroachment. In this case, it was the wealthy land and slave owners of the south who saw Hamilton’s bank as an intrusion and peril on their slave-based agricultural industry and the wealth it endowed them with.

It took a few decades for the southerners to achieve their aim, but once Andrew Jackson, a son of the south, became president in 1829, Hamilton’s bank was dead, and with it, economic stability in the U.S. went south also. For the next 30 years, the U.S. went through boom and bust cycles, due to the fact that banks throughout the U.S. were free to issue their own currencies, creating a Wild West of economic precariousness and unreliability. By one count, there were over 8,000 different currencies circulating throughout the nation.

This was the situation until 1862, when President Abraham Lincoln and Congress put the U.S. back on stable ground when it passed, over three consecutive years, finance laws—a currency act, national bank act, and legal tender act. The next step in financial stability occurred 50 years later in 1913, when Congress created the Federal Reserve, at last setting up a central bank to oversee the nation’s monetary policy. The final step in economic reform was 1933, when President Franklin Delano Roosevelt took the U.S. off the gold standard, a step that allowed Roosevelt to usher in the New Deal, creating policies that stayed in effect for four decades, which helped establish a more equitable society.

The opposition Alexander Hamilton faced from the wealthy elite because of his creation of a central bank was the first of many demonstrations of obstruction and subversion by the rich of any sort of public policy that threatened their power and wealth.

From the slaveowners of the south during the early to mid 19th century; to the robber barons of the late 19th century; the wealthy banking interests of the 1930s who tried to stop FDR’s New Deal; to our current times when Wall Street and the Koch Network of billionaire right-wing dark money oligarchs are doing the most harm, it’s always been the same old story: Laws are passed to protect the interests of the wealthiest at the expense of everyone else; not only does the general public suffer, but so does democracy itself.

By the 1920s, the wealthy elite had their hands on the till of the banking system and took the lion’s share of the money. All this changed after the election of FDR, when he wrested control of monetary policy away from Wall Street and enacted policies that allowed for shared prosperity for all.

Roosevelt saw the misery the unregulated financial industry had sowed on the public with the financial crash of 1929. At the time, he was governor of New York, and from his vantage point he observed the wreckage that ensued: 5,000 bank failures, 100,000 jobs per week gone, 25 percent of the workforce unemployed. That is why, in his inaugural speech as president, Roosevelt promised to expel the “money changers” from the political system, saying, “They knew only the rules of self-seekers and had no vision, and when there is no vision the people perish.”

FDR knew what needed to be done, and had the leadership skills and courage to do so. He forced bankers to relinquish control of the monetary system, and in the process, for the first time in U.S. history, a true economic democracy was established. With those steps, and by taking the U.S. off the gold standard, he was able to address the plight of the millions of desperate Americans who were jobless and struggling to keep a roof over their head and food on the table. Austerity policies were over; the U.S. used public spending to institute a New Deal for all. Over FDR’s presidency, government spending was close to 40 percent of GDP, an unheard of amount at that time. This is what allowed the economy to begin its recovery.

FDR’s policies were so popular that for the next four decades, through Democratic and Republican administrations alike, the country continued to embrace public spending as the means to keep the nation prosperous. And for this reason, these four decades were the most buoyant and equitable period in American history.

Things shifted beginning in 1980, as the Reagan Revolution ushered in a new era of neoliberalism, a time that ushered in the financialization of the economy, mergers and acquisitions, corporate consolidation, and austerity. “Greed is good” was the motto of the era, and if you couldn’t make it, it was your own problem. And lots of people weren’t making it. Government was no longer seen as the solution, as people viewed it during the presidencies of FDR to Jimmy Carter; now government was the problem, as Reagan continually stated.

Meanwhile, European nations, having rebuilt from the ashes and devastation of WWII, were starting to be reborn as social democracies, and in doing so, guaranteed their citizens strong social safety nets and as a result, Europeans saw higher quality of life metrics and longer lifespans than their American counterparts. While American quality of life metrics continue to decline, the opposite holds true for Europeans.

In comparison with other developed nations, the U.S.has the lowest life expectancy; second highest poverty rate; spends the most on health care and has the worst health outcomes; has the highest child mortality rate; has a citizenry that spends the most on college; has the highest income inequality; and has the lowest voter turnout in elections.

All these facts made it no surprise when the U.S. ranked 28th on the most recent Social Progress Index, which uses 50 metrics to measure quality of life in countries around the world. Out of the 163 countries assessed worldwide, the United States, Brazil and Hungary are the only ones in which people are worse off than when the index began in 2011. And the declines in Brazil and Hungary were smaller than America’s.

This gloomy reality led Michael Porter, a Harvard Business School professor and chair of the advisory panel for the Social Progress Index to say “The data paint an alarming picture of the state of our nation, and we hope it will be a call to action. It’s like we’re a developing country.”

Alexander Hamilton would not be happy to know this. He envisioned a great and prosperous nation, spurred on by the national blessing of public debt that was invested in its people.

On Friday, Nov. 19th, 2021, the U.S. House of Representatives voted to pass the Build Back Better Act, and send it to the Senate, where sadly, thanks to Joe Manchin’s obstinacy, it is now on terminal life support. The Build Back Better Act covers child care, paid leave, the child tax credit, universal preschool, enhanced funding for climate and the environment, housing, expanding access to home health care, helps people pay their health insurance premiums, workforce development grants, small business support, and other programs.

The original bill was for $6 trillion, payable over 10 years. At the next stage of the bill, it was shaved down to $3.5 trillion. The version that passed the House was for $1.85 trillion, still paid over 10 years. Even at a watered-down version, the hope was that the legislation would prove as transformative as any since the Great Society and War on Poverty in the 1960s, especially for young families and older Americans.

But unfortunately, it doesn’t look like it’s to be.

Forty years of austerity has left America hallowed out. While I outlined in my last essay, Free Stuff and the Slimy Underbelly of Donald Trump

the abstract and obscene amounts of money that float around in the upper stratosphere of the wealth class, very few are privy to that abundance. Instead, the great majority of people are stuck in scarcity, of not having enough, and barely getting by. And after decades of living this way, they are angry with how their quality of life has deteriorated.

This level of anger is so high and so volatile, that over 30% of Republicans now say it will take violence to save America. Save from whom? Their answers are not clear. But that’s what decades of austerity will do to you—it causes you to not think clearly and instead lash all your venom out at those who you believe are your enemy, even though these self-perceived enemies are also struggling economically.

Let’s hope the U.S. Senate passes something resembling the latest version of the Build Back Better Act, and that it is the first step, but not last, in bringing back the vision of Alexander Hamilton, and of every other American, past and present, who believes in the importance of a nation that works for all.

Oh, Alexander Hamilton (Alexander Hamilton)

When America sings for you

Will they know what you overcame?

Will they know you rewrote the game?

The world will never be the same, oh

Leave a Reply